ASG Analysis: The New European Commission: Is a Circular Org Chart the Same Thing as a Circular Firing Line?

Summary

- Ursula von der Leyen (VdL), Europe’s new Commission President, released her nominees for the next European Commission on September 10.

- VdL has called this a “geopolitical” Commission. Efforts to boost Europe’s ability to compete against the U.S. and China, in technology, social media, and industry will be central to the agenda. American tech companies and industrial giants will come under greater scrutiny by a Commission with new powers to regulate the market and competition.

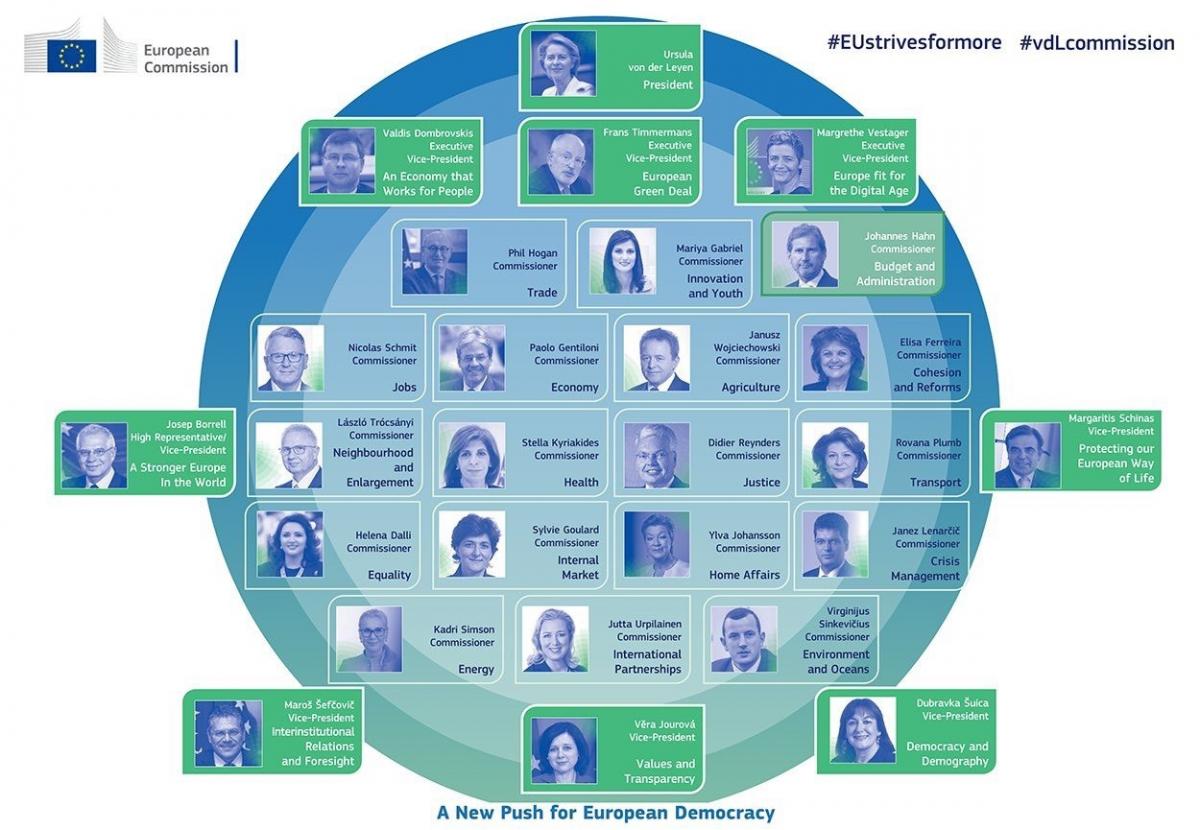

- The organization of the new Commission introduces a circular organization chart, with grand titles and unclear lines of reporting. VdL has described it as “balanced” between large and small states, left and right parties, old and new members, and by gender. A balance works only if there is tension between the parts, and there is a risk that policy will be slowed while the pecking order is sorted. Below are a few rules of thumb for understanding power in this Commission.

- The Parliament will review the nominations and vote the entire slate up or down by October 31. The new Commission is scheduled to take office on November 1, but delays for a month or more should not be surprising.

Discussion

VdL’s appointments make several priorities clear:

- Climate. First Vice President Frans Timmermans will have responsibility for a “European Green Deal.” This is a far-reaching portfolio in a Commission committed to ambitious carbon reduction. It will touch on every aspect of economic policy and so represents a post of influence for the center left and possibly a point of contention with the liberals and conservatives holding posts for internal market and digital reform. With no actual green representative in the College of Commissioners, this post is important for VdL to hold social democratic and some left support.

- Digital. Second VP Margrethe Vestager will oversee a suite of directorates with a focus on digital affairs. Vestager and France's Sylvie Goulard, who has internal markets, may be particularly important in establishing liberal, reformist European agenda. We expect a major focus on combating American and Chinese digital giants and building the environment for European champions. Several items deserve close attention:

-

- Competition – Data. Vestager will keep this role (and staff). Expect continued focus on the data policies of Facebook and Google, in particular. In the Juncker Commission, the Directorate General (DG) for Competition sought to shape behavior by lightning bolt, with fines and one-off judgments. It will be interesting if Vestager’s wider portfolio leads to more efforts to legislate what behavior is expected. The proposed Digital Services Act may be a step in this direction.

-

- Business Model – Ads and Content Moderation. Expect greater scrutiny of the data-driven, ad-sponsored business model of social media giants. One approach may be for the current Commission’s work on content moderation (hate speech, disinformation, etc.) to evolve into a review of why some platforms have built models that depend on, and reward, content that is sticky but too often toxic, false, and divisive.

- Digital Transition. Vestager has been tasked to work with Valdis Dombrovskis, who will run part of the economy portfolio, on a long-term strategy for an industrial Europe and a new SME strategy for a digitizing world. She will also coordinate digital taxation work, a new Digital Services Act, and a European approach to artificial intelligence.

Image: The European Commission's new, circular reporting structure. Source: European Commission.

- Competitiveness, Industrial Policy. There is momentum to develop a strong industrial policy to enable Europe to compete with U.S. and Chinese giants, especially in tech, including a review of how to approach to state aid and mergers. The new Commission will also look to expand its role in setting standards and shaping global trading rules as a way of countering Chinese influence and U.S. unpredictability.

- Trade. The EU will also look to be more assertive on trade talks, especially with Washington. Phil Hogan, the Irish nominee to be the next trade commissioner, has already warned Trump to “abandon some of [his] reckless behavior” on trade. We do not believe that the U.S. president wants a trade war heading into election year, so the tough talk may appear to be successful once each side postures. VdL has also called on Hogan to establish a “comprehensive agreement on investment” with the Chinese by the end of 2020.

- Foreign Policy. President Ursula von der Leyen has said that she plans to be a "geopolitical" president. This suggests a concentration of foreign policy around the Commission president, rather than with the High Representative, Spain's Josip Borrell, or the Council President, Charles Michel of Belgium. VdL will look to build greater consensus on issues of a European defense fund, border control, migration, foreign aid, and trade. We expect turbulence in U.S.-EU relations as the EU takes a harder line on trade and targets U.S. tech companies, even as the Trump administration attempts to show that it has a good relationship with VdL personally.

- Migration. Among the other portfolios, a sleeper for most important could be home affairs, handed to Sweden's Ylva Johansson with a leadership role for VP Margaritis Schinas. Migration is at the heart of domestic politics for multiple EU states. The Commission's ability to manage this issue humanely and effectively could determine whether the announced priorities stay at top of the agenda.

Other issues to watch

- Influence of major member states. Germany (head of the Commission), France, and Italy, together with Ireland, Denmark, and the Netherlands, hold crucial portfolios. This is Europe's old core. There will be competition between the center right (France, Denmark, Germany) and center-left (Netherlands, Italy), but much of Brussels policymaking will be driven by these states. While Brexit will remain front and center until it is resolved one way or the other, discussions on the future of the EU are likely to turn next to Macron’s preferred formulation of a multi-speed Europe; this time, Western Europe will be in the driver’s seat in Brussels.

- Unclear reporting lines and staffing. Four Vice Presidents have titles but no apparent authority, unlike in the Juncker Commission when each had supervisory responsibility.

- The role of the UK. There is no British Commissioner, and the Johnson Government in London presumably would not want one. If Brexit is delayed, however, there may be a question of whether to include one. The likelihood of this happening depends on the length of delay and on

- changes in British politics. If the UK ends up remaining through the end of this EU budget period (April 30, 2020) a temporary Commissioner might be part of a package.

- Deprioritized issues: rule of law and enlargement issues. The rule of law seems to be downgraded as a focus, perhaps because it created tension with Poland and Hungary. It is possible that some of those issues will arise in the context of the EU’s next multi-year budget, but the absence of this as a priority is unfortunate. The neighborhood and enlargement portfolios do not seem to factor into the core of this Commission’s strategy, being left to a new member state and with only a note that the Presidents wants candidates to be “as close as possible” to the EU – a position that may not mean membership.

What’s Next?

The new Commission is scheduled to take office on November 1, but speculation is that a delay may be necessary, given the delay in announcing portfolios.

It is likely that Parliament will not approve the slate as is. Hungary's László Trócsányi is a likely candidate to lose out for the post of enlargement. He is widely seen as a stalking horse for Hungarian leader Viktor Orbán, who has been a very partisan presence in EU candidate countries such as North Macedonia. The Romanian candidate will come under scrutiny due to corruption issues at home, and the Polish and French candidates are also addressing investigations.

December 1 is a possibility, although the new Commission may welcome the chance to come in slightly later if Brexit were to be resolved.

Albright Stonebridge Group (ASG) is the premier global strategy and commercial diplomacy firm. We help clients understand and successfully navigate the intersection of public, private, and social sectors in international markets. ASG’s worldwide team has served clients in more than 120 countries.

ASG's Europe Practice has extensive experience helping clients navigate markets across Europe. For questions or to arrange a follow-up conversation please contact Chris Maroshegyi.